The 2020 Year-end Market Report - Marco Island

Nobody could have predicted the real estate market activity that transpired on Marco Island in 2020. The year started off with a bang. The first quarter was even more active than typical. Then, silence. When nationwide lockdowns were instituted in an attempt to arrest the Coronavirus, real estate activity slowed dramatically on the island for two months. By the time summer arrived though, real estate sales were moving at a blistering pace again and have not slowed down since. The sudden demand has resulted in our listing inventory shrinking to record lows. Prices, which had floundered for a couple years, took off seemingly in an attempt to make up for lost ground.

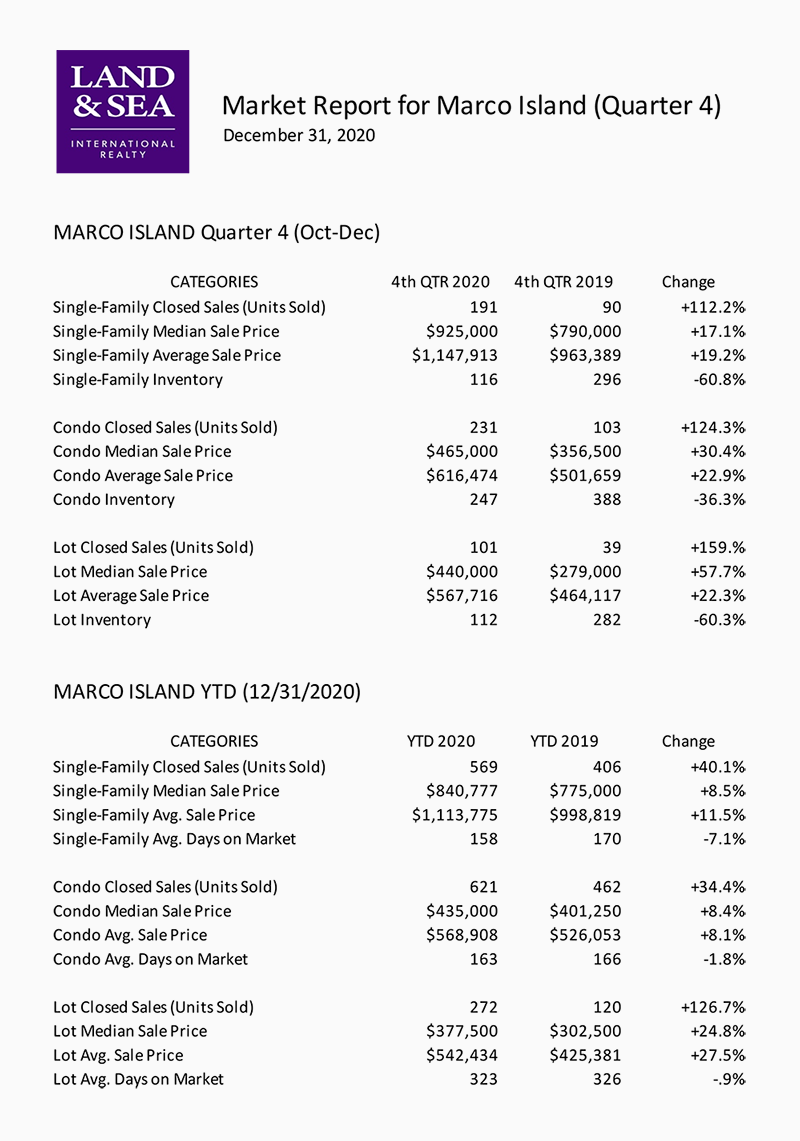

Zillow reports that overall prices rose 6.2% in 2020. This is substantially lower than the Marco Island MLS figures shown below.

Forecast

With the reduced inventory, we suspect values will continue to rise throughout 2021. Zillow forecasts prices increasing 5.7% this year. We think this is low. Of course, if new listings remain low, the shrinking inventory will eventually drive a slowdown in sales as there become fewer and fewer homes available to sell.

Pricing Pressure

In forecasting the market on Marco Island, we look for factors that have the potential to "push" prices either up or down. Things like the stock market, rental occupancy, migration within the country etc. push prices in one direction or the other.

The stock market appears overbought to many investors. Investors are reallocating cash to blue-chip real estate like Marco Island. Migration from the northern states into Florida is as strong as ever. Also, the political uncertainty that seems to exist in some states appears to be increasing the long-term upward pressure on Marco Island property values. Finally, the finite supply of Marco Island property rounds out a very positive outlook.

Interest Rates

Mortgage rates are hovering at historic lows. 15-year fixed-rate mortgages are currently at 2.125% and 30-year fixed are offered at 2.625%. This is as close to free money as it gets. The low rates are certainly contributing to the nationwide demand, and to that on Marco Island as well. Unlike the vast majority of U.S. housing markets, Marco is still observing a relatively high rate of cash purchases, though. The relatively high equity rate maintained on Marco Island is keeping property values reasonable. Homes and condos are continuing to appraise successfully.

Other Indicators

In 2020, the JW Marriott hotel on Marco Island enjoyed its first full year post-renovation. In 2016, the hotel embarked on what would ultimately become a 320-million dollar renovation and expansion of its iconic property on Marco Beach. Of course, nobody spends a third of a billion dollars without commissioning hyper-accurate demographic, risk and profit forecasts of the decades to come. We think this is one of the best indicators of Marco Island's long-term investment viability. Add to it the fact that hotel and vacation rental properties are at capacity, and Marco Island appears to be coming into its own as an upscale vacation destination and home address.

The Numbers

The stats below were taken from the Marco Island MLS and cover virtually all sales involving a Realtor on Marco Island in 2020.